According to Section 71 bis (2) of the Revenue Code specifies the characteristics of a company or juristic partnership that has relationships in three ways:

- A company or juristic partnership holds shares or is a partner in another legal entity, whether directly or indirectly, holding not less than 50 percent of the total capital.

- A shareholder or partner holds shares or is a partner in another legal entity, directly or indirectly, holding not less than 50 percent of the total capital.

- Juristic persons have relationships with each other in terms of capital, management, or control in such a way that one juristic person cannot operate independently from another, as specified by ministerial regulations.

There are often questions from companies or taxpayers, especially those where shareholders are natural persons, are major shareholders and hold shares in multiple companies. They inquire whether their group of companies (with total income in the accounting period not exceeding THB 200 million) is required to comply with the law by submitting a Disclosure Form or preparing documents or evidence showing necessary information for analyzing transaction terms between related companies or partnerships (Local File).

Before getting the answer, please consider the following examples:

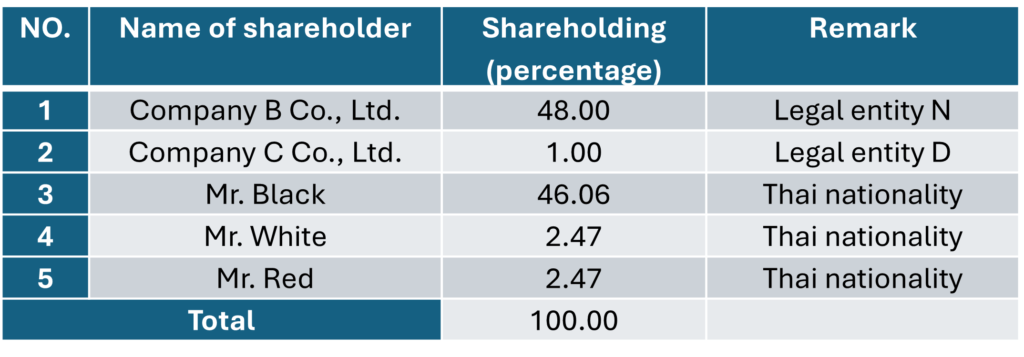

Example: Company A Company Limited engages in the production of computer equipment parts and has 5 shareholders:

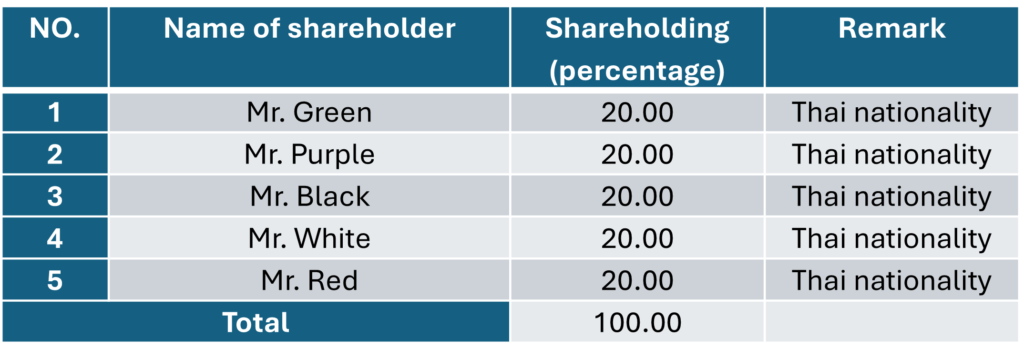

Some shareholders of Company A hold share in Company E (headquartered in Thailand), which operates a business selling office equipment, and has 5 shareholders as follows:

Diagnostic guidelines for determining whether shareholders or partners in a company or juristic partnership have a relationship, as per Section 71 bis, paragraph two, of the Revenue Code, include the following criteria:

In cases where a company or partnership consists of two or more juristic persons related such that multiple shareholders or partners collectively hold shares or are partners in a legal entity, whether directly or indirectly, amounting to not less than fifty percent of the total capital, and where those shareholders or partners also hold shares or are partners in another legal entity, whether directly or indirectly, amounting to not less than fifty percent of the total capital.

For example, Mr. Black, Mr. White, and Mr. Red collectively hold shares in Company A, totaling 51 percent of its capital, and hold shares in Company E, totaling 60 percent of its capital. Therefore, Company A and Company E, as two juristic entities, have a relationship due to multiple shareholders jointly holding shares in legal entities, whether directly or indirectly, amounting to not less than fifty percent of the total capital. This scenario meets the criteria of being a company or juristic partnership with a relationship under Section 71 bis, paragraph two, of the Revenue Code.

In summary, the determination of shareholders or partners who hold shares in a company or juristic partnership includes both individual shareholders and groups of natural persons holding shares amounting to not less than fifty percent of the total capital.

Reference: Response to consultation with the Revenue Department. Book number KK.0702/1978 dated 9 April 2024