News and Articles

Thailand is taking proactive steps to reform its parental leave policies to better support working families, align with international labor standards, and respond to demographic challenges such as declining…

On August 1, 2025, Thailand’s Personal Data Protection Committee (PDPC) issued a formal statement regarding a serious data breach involving a prominent private hospital. The incident has sparked widespread…

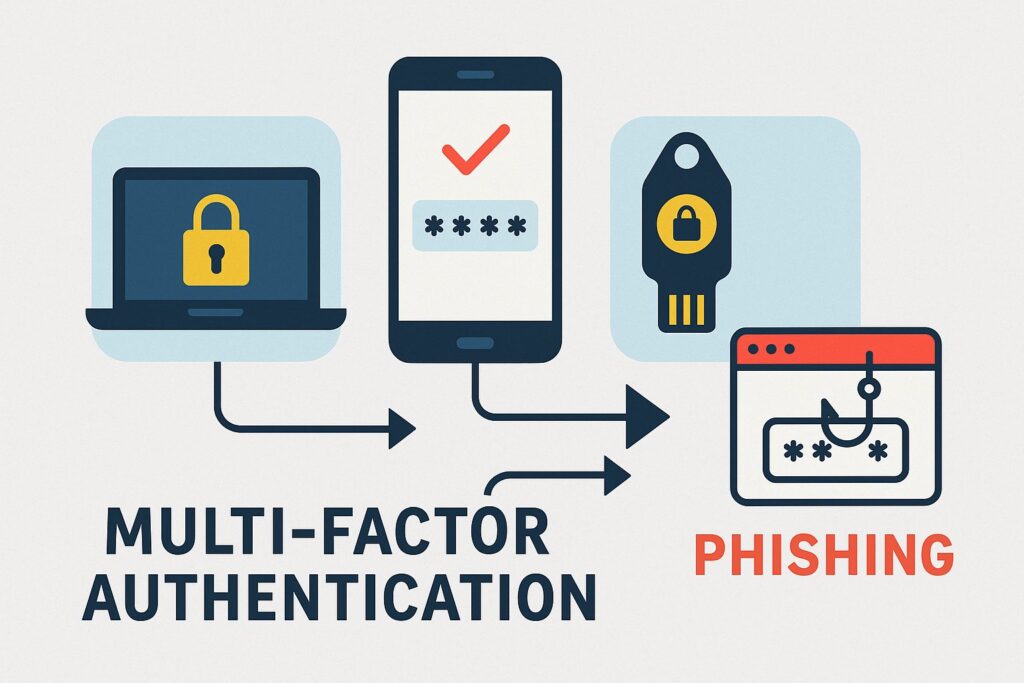

🔐 Overview Despite the rise in phishing‑resistant authentication methods such as FIDO2-based passkeys, WebAuthn, Windows Hello, and physical security keys attackers continue to successfully bypass them using more sophisticated…

The Thailand Board of Investment (BOI) has issued new criteria under Announcement No. Por.8/2568, dated June 5, 2025, regarding the approval, employment, and extension of foreign experts in BOI-promoted…

I’ve been following cybersecurity news for years, but what’s happening in Thailand right now has me genuinely concerned. It’s not just another data breach or ransomware story – this…

Starting October 1, 2025, Thailand will officially launch the Employee Welfare Fund (EWF) — a major

step forward in protecting workers’ financial well-being. After years of delay, this mandatory…

The massive excitement around Artificial Intelligence (AI) tools has become a goldmine for cybercriminals. They’re heavily using this buzz to trick people into downloading dangerous ransomware and malware. This…

Resume fraud has become an increasingly pressing concern for HR professionals and hiring managers. Recent studies reveal that this issue is more pervasive than many organizations realize, with significant…

“Imagine a world where your personal and sensitive information could be leaked without you even lifting a finger. This is not a scene from a sci-fi movie, but a…

PKF is here to help

Find out how PKF can help you get closer to your goals